Business

DUBAI: Abu Dhabi Royal To Invest In Banker Rajeev Misra’s New $6.8 Billion Vehicle

DUBAI: As Gulf oil wealth flows to all corners of the globe – backing mega mergers, propping up economies and upending the world of sport – moves by a key member of Abu Dhabi’s ruling family have positioned him as one of the world’s most influential dealmakers.

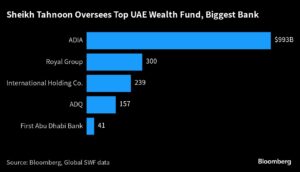

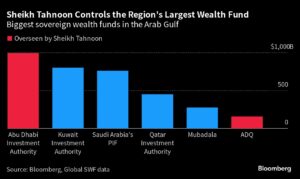

Over the past few months, Sheikh Tahnoon bin Zayed Al Nahyan has gained control of the largest sovereign wealth fund in the United Arab Emirates, expanding the assets he oversees to almost $1.5 trillion. He’s proceeded to bankroll billions of dollars in deals via an expanded empire of private and state entities.

Drawing in titans of finance such as Rajeev Misra and billionaire Ray Dalio, Sheikh Tahnoon – one of Abu Dhabi’s two deputy rulers, the UAE’s national security adviser and brother to its president – has sought to invest in everything from technology to finance, with varying degrees of success.

Known to be a fan of Brazilian jiu-jitsu, cycling and chess, Sheikh Tahnoon now helms two wealth funds, the region’s most important private investment firm, the country’s largest lender and its biggest listed corporate. That’s made him the de facto business chief of the wealthy Al Nahyan family, with access to seemingly endless reserves of cash in OPEC’s third-largest producer – an unusual amount of financial firepower even in the oil-rich Persian Gulf.

Born in the late 1960s – a few years after oil was discovered in Abu Dhabi and when the UAE was still a backwater populated by fewer than 250,000 people compared with close to 10 million now – Sheikh Tahnoon is increasingly becoming the face of his country’s global aspirations.

“The UAE leadership has recognized its most important source of statecraft is financial,” said Karen Young, a senior research scholar at Columbia University’s Center on Global Energy Policy. “It has the economic means to secure itself, to project power and to shape the politics around it in ways that it could never achieve with its small size or military power alone.”

“Sheikh Tahnoon is now the strategist behind multiple economic statecraft tools and the ability to use economic means of foreign policy support,” she said.

Early considerations to buy Standard Chartered Plc and Lazard Ltd. at the start of this year, even though ultimately unsuccessful, highlight the scale of his ambitions.

Other prominent deals include an investment in TikTok Inc.’s Chinese owner ByteDance Ltd, a $10 billion fund targeting opportunities in tech, an agreement to bankroll Mr Misra’s new $6.8 billion vehicle and a takeover of Colombia’s largest food-maker in partnership with billionaire banker Jaime Gilinski.

Another of his main entities – G42 – is partnering with Cerebras Systems Inc., which recently built the first of nine AI supercomputers as an alternative to systems using Nvidia Corp. technology.

Despite the vast financial resources at his command, Sheikh Tahnoon’s entities have sometimes struggled to hammer out cross-border deals, like the one for Standard Chartered, due to difficulties navigating complex M&A regulations overseas. There are likely to be more challenges ahead.

Bankers and lawyers warn that some of Abu Dhabi’s investment vehicles could be slowed by national security reviews as the US Committee on Foreign Investment broadly conducts more stringent checks on deals by international investors with business ties to the Chinese government. The UAE is also set to join the BRICS grouping of major emerging markets, moving closer into Beijing’s orbit.

US deals have become more complex for Gulf entities, according to Lynn Ammar, an Abu Dhabi-based partner at law firm Cleary Gottlieb. “The broad geographic scope is likely to continue to attract attention from FDI authorities, such as CFIUS, who may be concerned about potential information flow to China,” she said.

Such added pressures come at a time when Sheikh Tahnoon’s investment vehicles are showing a particular affinity for emerging markets. G42’s tech fund is building teams in Asian cities, including Shanghai, to scout for investment opportunities, Bloomberg has reported. Meantime, his private investment firm Royal Group has long prized India, which executives there have called the potential growth engine of the next decade, people familiar with the matter said.

G42 has also been in advanced discussions to expand its human genome project to countries across Africa and Asia, according to the people. The US, Europe and Latin America are additional markets of interest to Royal Group.

Sheikh Tahnoon’s International Holding Co is actively exploring opportunities in emerging markets, the Abu Dhabi conglomerate’s chief executive officer Syed Basar Shueb said in written comments in response to questions from Bloomberg. Shueb, one of the royal’s top lieutenants, said joining BRICS would allow the country to strengthen its global partnerships.

Representatives for Royal Group, G42, the UAE’s government media office and Ministry of Foreign Affairs didn’t respond to requests for comment.

Sheikh Tahnoon was handed control of Abu Dhabi Investment Authority following a reshuffle in March. Days later, UAE ruler Sheikh Mohammed bin Zayed – known as MBZ – named his eldest son Sheikh Khaled bin Mohammed as crown prince and thus heir, after having held the position open for a year.

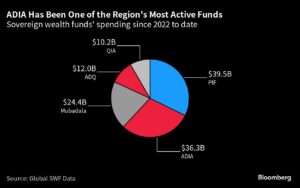

The $993 billion ADIA is among the world’s largest wealth funds and ranks as the second-biggest spender on deals among regional peers since the start of 2022 – just behind Saudi Arabia’s Public Investment Fund, according to data from Global SWF. Sheikh Tahnoon’s other vehicles, including the secretive Royal Group, have splashed out billions more.

Still, Abu Dhabi’s financial heft hasn’t always been enough. First Abu Dhabi Bank PJSC, the lender overseen by Sheikh Tahnoon that weighed a bid for Standard Chartered, bought Bank Audi’s Egyptian unit in 2021. But a year later it withdrew a $1.2 billion bid for Egyptian investment bank EFG-Hermes after facing lengthy regulatory delays, Bloomberg has reported. In the case of Standard Chartered, getting a deal done was ambitious given the differences in the scale of the two banks. Regulatory approvals and compliance were also obstacles to a successful deal.

Luring Billionaires

The emirate remains a hub of deal-making, though, and Sheikh Tahnoon has been central to the city’s efforts at leveraging its expanding financial influence to draw more billionaires. Bridgewater Associates founder Dalio is setting up a branch of his family office in Abu Dhabi and partnering on deals with Sheikh Tahnoon, Bloomberg has reported.

As a diplomatic troubleshooter for his brother, the president, Sheikh Tahnoon has also helped his country push into geopolitically significant markets around the world. The UAE has signed a string of agreements to invest in Asian and African economies, including in Indonesia where G42 and Dalio have held discussions about partnering to help build the new capital city. Regionally, the royal has been at the forefront of investments in Egypt and, more recently, Turkey – where the Gulf country has pledged to pump in more than $50 billion.

“There’s definitely a geo-strategic component to some of Abu Dhabi’s overseas investment,” said Steffen Hertog, an associate professor at the London School of Economics. “Given Sheikh Tahnoon’s security background and role as high-level emissary in the MENA region in particular, you’d expect the funds under his control to incorporate such dimensions.”

Bigger Than Goldman

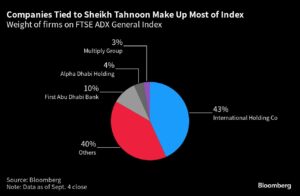

Sheikh Tahnoon’s influence has, of course, been felt locally too. A key part of his empire is IHC, which has morphed into a $240 billion behemoth from an obscure fish farming firm in just a few years. It’s now twice the size of Goldman Sachs Group Inc. and Blackstone Inc, but that hasn’t enticed many international investors and IHC isn’t covered by analysts tracked by Bloomberg.

“IHC’s commitment to transparency is evident in its ‘day-to-day’ business activities, which include consolidating real estate assets and forming strategic collaborations that drive synergies and value,” CEO Shueb said in written comments. “These activities allow IHC to unlock new opportunities and maximize the potential of its assets on both local and international levels.”

The firm’s surging stock price has helped buoy the local bourse, which has rallied 92% since the start of 2020. In a period that saw investors flee emerging markets – the benchmark MSCI index is down about 11% – the Abu Dhabi Exchange, owned by ADQ, added over $600 billion to its market capitalization, which stood at about $750 billion as of the end of last week.

Some of those gains came on the back of deals involving the royal’s private holdings and the sovereign wealth funds he oversees. The latest example, which involved ADQ and IHC, created a $12 billion real estate behemoth. Earlier this year, the two firms also inked a partnership with the $73 billion private equity giant General Atlantic on a new venture to invest in alternative assets.

Sheikh Tahnoon’s “financial vehicles also serve to create new entities that generate wealth for next generation members of the ruling family and to secure the dominance of state-related entities within a wider market system,” Columbia University’s Young said.

Business

NEW YORK: H1B Visa “Thing Of Past”: Union Minister Piyush Goyal After US Visit

NEW YORK: Union Minister of Commerce and Industry, Piyush Goyal, declared that the H1B visa issue is now “a thing of the past” during a meeting at Vanijya Bhavan, New Delhi.

He emphasized that the topic would no longer be a point of discussion in international dialogues, marking a shift in focus towards other areas of economic and strategic partnerships.

Minister Goyal’s recent visit to the United States included a two-day stay in New York, where he met with CEOs of major companies to discuss reforms initiated by the Modi government aimed at boosting foreign investments in India, particularly in the pharmaceutical and diamond sectors.

Surat, a prominent hub for the diamond industry, was highlighted as a key region for such investments. Goyal met around thirty business leaders who have already established ventures in India, signalling continued interest in expanding business operations in the country.

Following his engagements in New York, the Minister travelled to Washington, where he had a luncheon meeting with 17 CEOs from the CEO forum, including Tata Sons’ top executive.

The discussions primarily centred on restructuring the forum, as the terms of several members are set to expire in December. Various Memorandums of Understanding (MoUs) were also signed during the visit, underscoring the commitment to deepening business ties.

The visit also involved meetings with Small and Medium-sized Enterprises (SMEs), think tanks, educators, and the Center for Strategic and International Studies (CSIS). Goyal described this visit as different from previous trips, noting that there were no “negative agendas” on the table, reflecting a more positive outlook towards Indo-US relations.

Discussions extended beyond traditional sectors, covering potential partnerships in critical areas such as clean energy development, technology transfer, digital telecommunications, and defence.

Talks on biosciences have been ongoing, though Goyal noted that progress on biofuels was limited due to the upcoming US elections.

There were also conversations about setting a stable exchange rate between the Indian rupee and the US dollar, which could benefit bilateral trade.

Tourism and the development of the digital economy were also focal points during his meetings. Goyal’s engagements at the CEO forum and with the CA forum aimed to showcase India’s evolving business landscape and ongoing economic reforms, positioning the country as an attractive destination for global investment.

Business

LONDON: Focus On UK Visas For Indians As Tory Leadership Contest Enters Last Leg

LONDON: The two frontrunners in the race to replace Rishi Sunak as Conservative Party leader and take his place in the House of Commons as Leader of the Opposition have thrown the spotlight on cutting immigration into the UK, with visas for Indians being singled out in heated debates.

Against the backdrop of the launch of the Conservative Party conference in Birmingham on Sunday, former immigration minister Robert Jenrick singled out India as one of the countries that should be subjected to tough visa restrictions across all categories unless it takes back its nationals who enter Britain illegally.

His closest contender, shadow housing secretary Kemi Badenoch, has also zeroed in on the same issue and condemned new migrants bringing their disputes from India to cause unrest on the streets of the country.

“It is quite clear that there are many people who have recently come to this country who have brought views from their countries of origin that have no place here,” Badenoch told the BBC.

“I saw as equalities minister people bringing cultural disputes from India to the streets of Leicester… we need to make sure that when people come to this country, they leave their previous differences behind. This is not a controversial thing to say,” she said.

Nigerian-heritage Badenoch, considered among the favourites to win the ongoing Tory leadership election, was apparently referencing the clashes that broke out in Leicester in September 2022 in the wake of an India-Pakistan Asia Cup cricket match.

Meanwhile, her former ministerial colleague Robert Jenrick who has notched up an early lead in the contest told ‘The Daily Telegraph’ earlier this week that while India benefited from 250,000 visas in the past year, there were as many as 100,000 Indian nationals estimated to be illegally residing in the UK.

He lamented that deportations or removals to India remain stuck in the hundreds despite an India-UK Migration and Mobility Partnership which is designed to cover such returns of illegal migrants.

“The government must stop other countries exploiting our generosity by imposing severe visa restrictions and restricting foreign aid to countries that do not take back their nationals here illegally,” said Jenrick.

Over the four-day Tory conference starting on Sunday, Jenrick and Badenoch will go head-to-head with two other party colleagues – former Cabinet ministers James Cleverly and Tom Tugendhat – as they make their leadership pitches before MPs vote in the next round. This time the field will be whittled down to the final two candidates who will then fight it out for the online ballot of the wider Conservative Party membership, many of whom will be making up their minds during the party conference. The new Conservative Party chief and Opposition Leader is then scheduled to be declared on November 2 after the voting closes.

The election follows the resignation of Sunak as Tory leader in the wake of the party’s bruising general election defeat in July under his leadership. The British Indian politician, who was re-elected member of Parliament from Richmond and Northallerton in northern England, has meanwhile been serving as interim leader until his successor is elected.

Business

ATHENS: Indian Investors Rush To Buy Houses In Greece Under Golden Visa Scheme

ATHENS: Greece has witnessed a remarkable 37 per cent surge in property purchases by Indian investors between July and August. This flurry of activity is driven by Indian buyers eager to secure permanent residency under Greece’s Golden Visa Programme before significant regulatory changes took effect on September 1.

Launched in 2013, Greece’s Golden Visa programme offers residency permits in exchange for property investments, making it an attractive option for non-EU citizens. Its initial €250,000 (Rs 2.2 crore) threshold was one of Europe’s lowest, drawing significant investment and boosting Greece’s real estate market.

However, the surge in demand pushed up property prices, particularly in high-demand areas like Athens, Thessaloniki, Mykonos and Santorini. To address this, the Greek government raised the investment threshold to €800,000 (approx Rs 7 crore) for properties in these regions, effective September 1 2024.

Sanjay Sachdev, Global Marketing Director of Leptos Estates, noted an “unprecedented rush” of Indian homebuyers in recent months. “Many investors purchased under-construction projects with handover periods of six-twelve months,” said Sanjay Sachdev, as per MoneyControl.

Many invested in properties under construction, with completion timelines of six to twelve months. Leptos Estates reported selling out its available residential stock in Greece due to this surge.

Effective September 2024, the revised Golden Visa programme seeks to:

– Temper rapid price increases

– Promote equitable development

– Direct investment towards less saturated areas

The appeal of Greece’s Golden Visa Programme for Indian investors

– Greece offers attractive rental yields of 3-5 per cent annually, making property investments financially rewarding.

– Property values in Greece have been increasing at an impressive rate of 10 per cent year-on-year, with significant growth following the pandemic.

– Investors gain access to high-quality healthcare, education, and the opportunity to establish businesses within the EU.

Before the rule changes, Indian investors gravitated towards popular Greek islands like Paros, Crete, and Santorini for property purchases.

-

Diplomatic News1 year ago

Diplomatic News1 year agoSTOCKHOLM: Dr. Neena Malhotra appointed as the next Ambassador of India to the Kingdom of Sweden

-

Opinions5 years ago

2020 will be remembered as time of the pandemic. The fallout will be felt for years

-

Technology2 years ago

Technology2 years agoMARYLAND: All About Pavan Davuluri, New Head Of Microsoft Windows

-

Diplomatic News1 year ago

Diplomatic News1 year agoKINGSTON: Shri Subhash Prasad Gupta concurrently accredited as the next High Commissioner of India to St.Vincent and the Grenadines

-

Politcs2 years ago

Politcs2 years agoLONDON: Indian-Origin Candidate On How He Plans To Win London Mayoral Polls

-

Health1 year ago

Health1 year agoWASHINGTON: Social Media Has Direct Impact On Mental Health- US Surgeon General To NDTV

-

Sports2 years ago

Sports2 years agoSINGAPORE CITY: Indian Wins Big In Singapore Company’s ‘Squid Game’ Survival Contest

-

Sports2 years ago

Sports2 years agoPARIS: Titanium Tomy becomes 1st Indian to sail solo around the world, comes second in global race